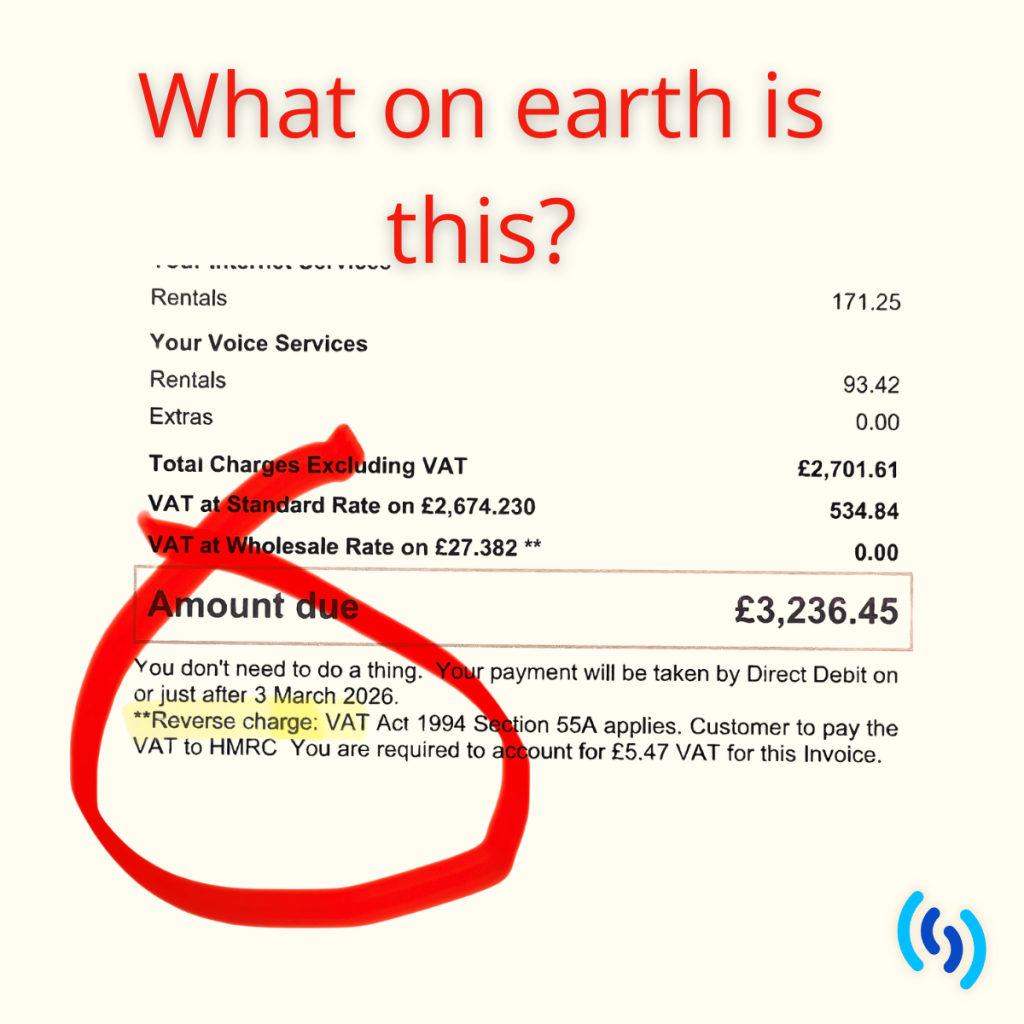

VAT isn’t usually the most exciting part of the telecoms industry, but if you sit anywhere in the middle of the supply chain — broker, reseller, or intermediary — you’ve probably come across reverse VAT and wondered why invoices suddenly look… odd.

In simple terms, reverse VAT flips the usual rules. Instead of the supplier charging VAT and handing it over to HMRC, the customer accounts for the VAT themselves. No VAT charged on the invoice, but VAT still exists — it just moves behind the scenes.

So why does telecoms get this special treatment? Because historically, the sector has been a magnet for VAT fraud. The high value, small items are ideal for such fraud schemes as the fabulously named Dutch Carousel which defrauded millions of pounds of tax (read more here if you like real life crime stories). The reverse charge was introduced to reduce that risk by stopping VAT cash moving up and down the chain where it could disappear. All the makings of a fraud drama on Netflix, and much better for HMRC.

Now, here’s where people often get caught out.

If you’re in the middle of the supply chain, buying mobile phones (and some services) and selling them on, reverse VAT usually applies to your purchase invoice if the amount is over £5,000. That means:

- Your supplier doesn’t charge VAT

- You record both the output and input VAT yourself

- The net effect is usually neutral (assuming full recovery)

This can feel counter-intuitive at first. No VAT on the invoice can look like something’s missing — but it isn’t. It’s just being accounted for differently and no money changes hands.

When you then invoice your customer, what happens next depends on who they are and where they sit in the chain. If reverse VAT still applies, you may also issue a VAT-free invoice with the appropriate wording. If it doesn’t, VAT is charged as normal.

And yes, eventually, the end user will still suffer the VAT. Reverse VAT doesn’t make VAT disappear; it simply changes who accounts for it and when. Brokers aren’t dodging VAT here, they’re just not acting as a VAT collection point.

The key thing is that reverse VAT isn’t optional, and it isn’t a clever workaround. If it applies and you charge VAT anyway, that can cause real problems down the line. Likewise, failing to apply it when required can create exposure you really don’t want.

The good news? Once you understand the logic, it becomes much less scary. Your invoices aren’t broken. The VAT hasn’t vanished. And you’re not doing anything wrong — provided the wording, treatment and reporting all line up. Your accounts package probably has a special Reverse Charge VAT code in it to account for everything properly for you. You will also be on the alert for potentially fraudulent larger phone invoices which do have VAT on. You might imagine that despite the legislation, fraudsters will just charge the VAT anyway and run off with it, secure in the knowledge that most people will not know the difference, so be on the alert!.

If you’re ever unsure, it’s always worth checking rather than guessing. Reverse VAT is one of those things that’s deceptively boring until it goes wrong — and then it suddenly becomes very interesting.

If you’d like to talk through your current setup or get a quote for business mobiles, VoIP or broadband, give Simpatico a call or an email, and we can find the best tariffs and deals for you, with 5* customer service as standard.